The Thread Briefing: the beauty market gets a makeover, postpartum innovation and 'doing a capitalism'

Welcome to the latest issue of Thread Briefing, a fortnightly round-up of the smartest things we’ve ingested recently, summaries of key trends, insights and a snapshot of what we’ve been up to in London, Hong Kong and beyond.

Coming up this week…beauty gets a makeover, taking better care of mums, and doing a capitalism!

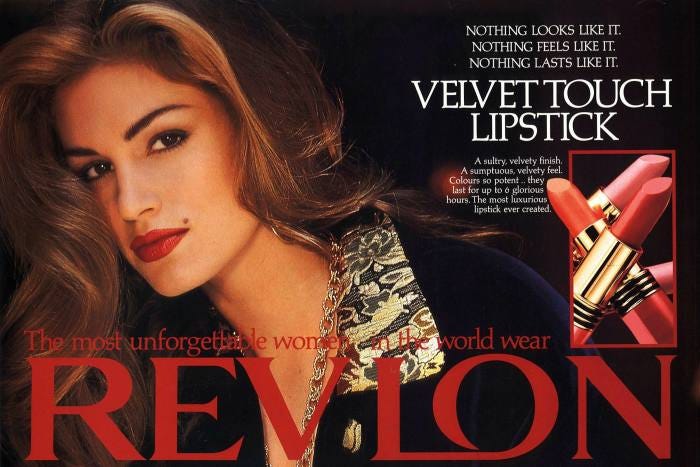

Fashion and beauty (business) models

Legendary beauty brand Revlon filed for bankruptcy last week, citing supply chain issues and crippling levels of debt off the back of a long-term decline in sales. It’s huge debt repayments may be one of the reasons it wasn’t able to invest in digital transformation to the extent of its competitors, and why it was unable to acquire start-ups appealing to younger customers in the way their competitors were able to. But it’s also an example of a huge incumbent brand who just seemed slow and late to adapt in an industry undergoing rapid change, all fuelled by new technologies, changing customer expectations and a plethora of new entrants such as Fenty Beauty by Rhianna in collaboration with LVMH, beauty subscription service Birchbox, and unicorn beauty brands by Kylie Jenner and Kim Kardashian, both of which have had stakes acquired by Coty.

Meanwhile, fast-fashion brand Shein has recently become the world’s fourth most valuable private company, after overtaking Amazon to become the #1 shopping app in the US and becoming bigger than Zara and H&M combined. Yes, it’s got a marketing machine attuned to the TikTok generation and a colossal ad budget, but most importantly it’s invested heavily over the last six or seven years in the “dirty work” behind the scenes to develop a world class supply chain and infrastructure to ensure it could respond in almost real-time to customer demand whilst reducing inventory risk.

The importance of inventory risk is at the heart of another new business model shaking up the sector. Retail brand Italic is pioneering a ‘direct-from-manufacturer’ model, offering customers the chance to buy unbranded luxury-grade products from the same manufacturers that supply famous brands like Prada. Italic offers these small often family-owned factories the technology, fulfilment, and distribution they need to sell their products directly to customers on the Italic marketplace, which gives customers access to products 50-80% cheaper than the equivalent from a famous brand, and allows these manufacturers to get a higher yield from their production line. In exchange for a getting a higher price for their products, the factory commits to holding the inventory, which reduces the risk for Italic compared to other retailers. This is smart and timely: as inventory costs soar some US retailers are considering allowing customers to keep unwanted goods, rather than deal with the costs of returns and re-selling.

Another new-ish player sourcing directly from manufacturers and cutting out traditional brands and retailers is Beauty Pie, using a Buyer’s Club model akin to Costco but for Gen Z beauty junkies. Members pay a monthly or annual subscription which allows them to access high quality beauty products at large discounts. Like Italic, the secret ingredient here is sourcing directly from the labs that make the beauty products and being transparent about the price with customers, something the the founder Marcia Kilgore refers to as ‘sourcing as a service’. It’s early days and likely the company isn’t profitable given their growth, but over the medium to longer term there are examples of big brands like Costco that have successfully made this model work, by keeping product margins tiny or non-existent and making all the profit from membership fees. The big unknown, of course, is how big the market for this model really is.

Thread’s take

Here at Thread we love business models like Ron Burgundy loves scotch, so it’s fascinating to see the old and the new rise and fall in such competitive markets as fashion and beauty. These examples demonstrate two things:

Firstly, that a compelling customer proposition is just one part of business model innovation, and genuinely different propositions often need genuinely different operations, cost structures, revenue models and/or distribution models. Revlon changed too little too late.

Secondly, and crucially, these elements need to be mutually reinforcing. Shein’s huge investment in its supply chain and data means it can deliver on it’s promise for ‘real-time fashion’ without being crushed by inventory risk and it’s expertise in SEO and digital marketing means it can reach and connect with the right customers with this compelling offer. While Beauty’s Pie’s membership model pays dividends because it’s done the hard work to establish relationships with labs across its supply chain to ensure the cost of the membership is outweighed by the great deals it can negotiate. The great e-commerce platform, compelling brand and adept use of social media brings this all together into a great user experience.

Postpartum Innovation

We recently published a short report all about innovation opportunities in Postpartum care. Most Western countries put the needs of babies (postnatal) ahead of mothers (postpartum), and solutions that do cater to mum tend to be predominantly medical and very functional. E.g. breastfeeding accessories and perineum pads; very little on nutrition, mental health, getting back into exercise or returning to work. This level of care is lagging behind the changing expectations and demands from parents around holistic health and wellness. We think there are huge opportunities for ambitious brands to move into this space and address these underserved needs.

Our report introduces the key trends driving this category, highlights three opportunity areas and outlines five implications for brands. You can download the report here, and do get in touch if you’d like us to present to your team.

The End of the Millennial Lifestyle Subsidy

Last issue we talked about the end of cheap money and how ‘start-ups’ like Uber are having to focus on unit economics rather than growth at all costs.

Derek Thompson at the Atlantic highlights how this pivot by tech companies to ‘doing a capitalism’ will be felt disproportionately by younger people who were the heavy users of these lavishly funded start-ups and now facing huge price hikes.

It was as if Silicon Valley had made a secret pact to subsidize the lifestyles of urban Millennials. As I pointed out three years ago, if you woke up on a Casper mattress, worked out with a Peloton, Ubered to a WeWork, ordered on DoorDash for lunch, took a Lyft home, and ordered dinner through Postmates only to realize your partner had already started on a Blue Apron meal, your household had, in one day, interacted with eight unprofitable companies that collectively lost about $15 billion in one year.

Tasty morsels worth sharing:

Apparently 81% of consumers in the U.S. believe it’s important for companies to act sustainably, and yet, according to a new Fast Fashion report, the global fast-fashion market is predicted to grow to $133.43 billion over the next four years at a CAGR of 7.7%. 🤔 File under ‘people’s attitudes and behaviours are not correlated’.

Once you pop you really can’t stop. The global juggernaut that is the Pringle. 🧐

Interesting to see a new smartphone brand launch, backed by former iphone designer Tony Fadell. 📱

Fascinating how regularly John Lewis is announcing new services and innovations recently: bike hire, kids clothes hire, build-to-rent and now botox and other ‘cosmeceutical’ treatments are available in some of it’s stores. 💉

Yikes. While it’s acquired 13 million customers and $100bn in deposits, the consumer arm of Goldman Sachs, Marcus, will not hit its target of breaking even this year, with further losses predicted on top of the $1.2bn it’s already chalked up. 💰

It’s not just start-ups that are having trouble raising money…

And finally…

This past fortnight we’ve been working on our Postpartum Innovation report, exploring new models in EdTech and running an online community around health and wellness. If you’d like to discuss how we approach product, service and business innovation at Thread, please don’t hesitate to get in touch.

Thanks for stopping by.

If you have comments, feedback or suggestions, please hit reply and let us know.